The news of the day was of course the ECB’s interest rate decision. The base interest rate remained at 4.50 percent. No one expected otherwise. There was therefore hardly any market reaction at first. Well, the AEX shot from light red to green, then dropped far and then recovered. Things went all over the place today.

In the explanatory memorandum, the ECB writes: “Inflation has fallen further, mainly due to lower food and commodity price inflation. Most measures of underlying inflation are weakening, wage growth is gradually moderating and companies are absorbing part of rising labor costs in their profits. Financing conditions remain restrictive and previous rate hikes continue to depress demand, helping to drive down inflation. But domestic price pressures are strong and are keeping services inflation high.”

We kept our interest rates unchanged at our latest meeting.

See our monetary policy decisions https://t.co/nLLQk6w1bL pic.twitter.com/rZ8Wex669f

— European Central Bank (@ecb) April 11, 2024

Expectations for European interest rate cuts unchanged

The market is still counting on a first interest rate cut in June, because the ECB will probably have sufficient economic data available to justify this. Last week it became clear that inflation in the euro zone in March amounted to 2.4 percent and core inflation to 2.9 percent. The ECB aims for a sustainable inflation level of around 2.0 percent. Economic growth in Europe is not slowing down.

State Street Global Advisors was quick with an initial response: “We think the ECB can prepare the market for an interest rate cut in June. Barring major surprises in the upcoming wage and inflation figures, we expect the ECB to lower the policy rate this year could probably reduce by 100 basis points.”

According to BlackRock, the chance that the ECB will cut in June has increased rather than decreased today, but what happens next is highly uncertain. What is certain is that we will not quickly return to the zero interest rate climate of a few years ago. Of course that wouldn’t be good at all. “Investors should keep the big picture in mind: rates in the euro area will likely stay structurally higher than before the pandemic. This rate cutting cycle will not be as deep as previous ones.”

Inflation in the eurozone is not yet where it should be, the uncertainty about its further development is very high (see the US!) and yet the ECB is keen to cut interest rates in June whatever it takes. Says everything about the ECB’s preference and backbone.

— edin mujagic (@edinmujagic) April 11, 2024

Fed is in a tougher package

While the ECB could cut interest rates for the first time in June, this is no longer a certainty for the Fed. Yesterday the American inflation figures for March were released and they were disappointing.

The hope was for an inflation of 3.4% and it was 3.5%. Not shocking in itself, of course, but it clearly does not indicate a downward trend in inflation that the Fed first wants to see before deciding to lower policy rates. It was the third month in a row that US inflation figures were higher than hoped. While European shares found their way back up again yesterday after a brief shock, Wall Street opened and closed sharply in the red.

Goldman has changed their Fed call. Pushed back forecast of 1st rate cut from June to July. Expect cuts at a quarterly pace after that, which now implies 2 cuts in 2024 in July and Nov. Options trader have pared their rate-cut expectations for 2024 to <2. pic.twitter.com/yUl4eQ6yO8

— Holger Zschaepitz (@Schuldensuehner) April 10, 2024

Today in us #stock market message; The fresh inflation figures do not give the Fed the desired confirmation that inflation is moving towards 2 percent on an annual basis. And with that, the chance of 3 interest rate cuts this year is slowly disappearing behind the horizon.

— Fintessa (@Fintessa) April 11, 2024

Will meal delivery companies consolidate this year?

According to analysts at Barclays, growth in the food delivery market looks solid, with more than ten percent in 2024. But a consolidation battle could be the real story this year. For example, Barclays believes that the American parties DoorDash and Uber, whose shares are at record levels, may be looking for takeover targets.

In Just Eat Takeaway (-4.25%) Barclays sees sufficient positive elements, but a catalyst is needed, and that could be the sale of the American part Grubhub, the analysts think. Coincidentally, IEX analyst Martin Crum is also examining Just Eat Takeaway today. Crum sees no reason to adjust previously optimistic expectations for the stock. He only considers a sale of Grubhub possible once the fee cap in New York is abolished, including the associated damages.

The Just Eat Takeaway share was at a heavy loss of almost 5% around half past twelve, before rising slightly again. Yesterday the stock had actually increased considerably. Readers of IEX Expert will receive a new edition tomorrow containing an extensive interview with CEO Jitse Groen.

Read the interview with the CEO @jitsegroen from Just Eat Takeaway in the edition of IEX Expert that will appear tomorrow. You can read whether the Investor Desk shares its opinion on the share here: https://t.co/JoIYQndAGc

— IEX Investor Desk (@Beleggersdesk) April 11, 2024

Where is the self-driving car?

Several companies have already invested some time in the development of the self-driving car. Elon Musk has promised several times that it would be available ‘next year’, but it doesn’t seem to be getting any closer. Yet it must work sooner or later.

Tesla (-0.1%) is the most notable developer of self-driving technology, but Waymo, a subsidiary of Alphabet, and Mobileye, a subsidiary of Intel, are also well-known names. And there are even more players.

IEX analyst Ivo Breukink sees mountains of gold when self-driving cars hit the road. The increase in value per car is now estimated at at least $10,000.” It will take some patience. Read the whole story.

Top three risers and fallers of Beursplein 5

Shares in the spotlight

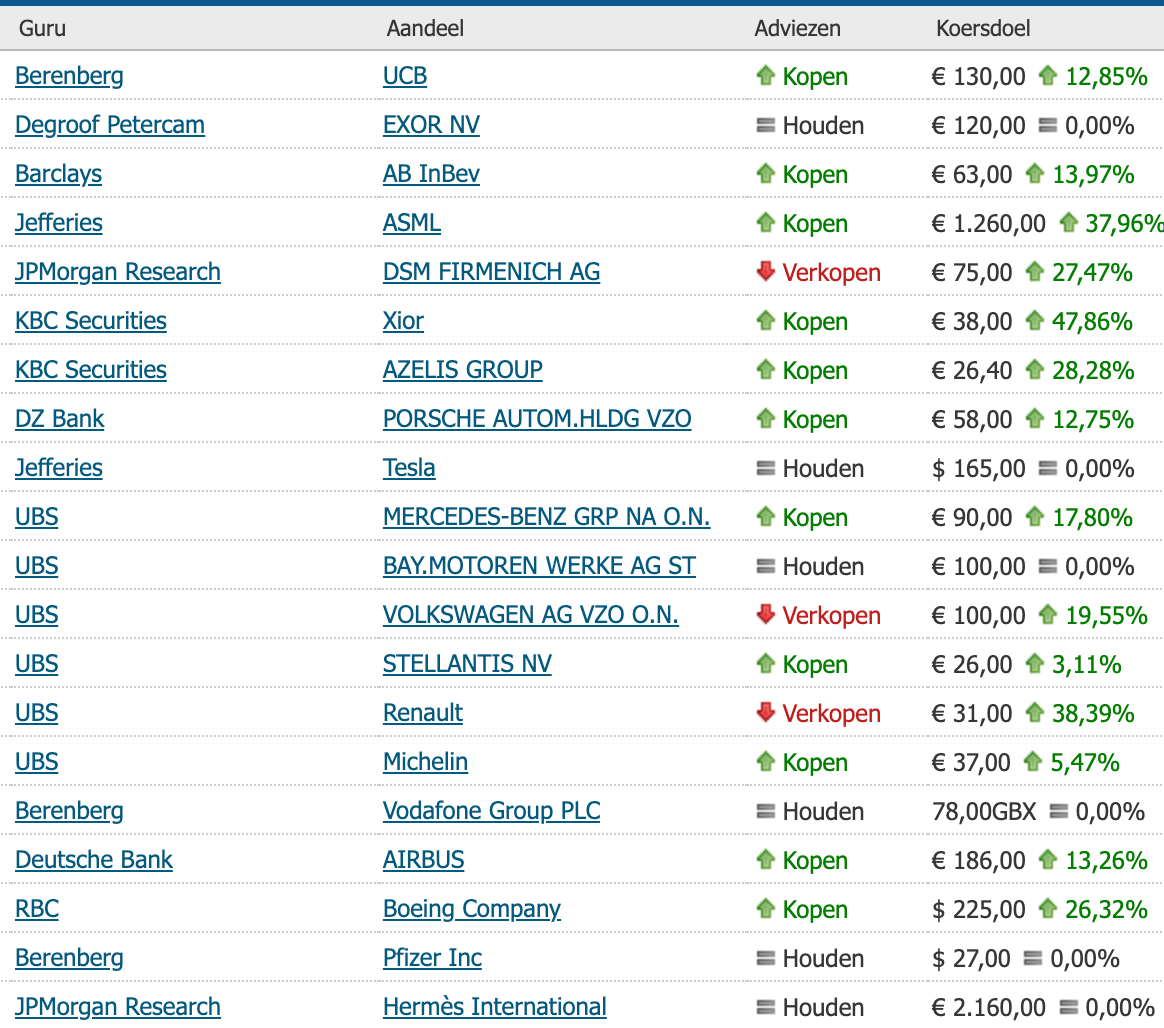

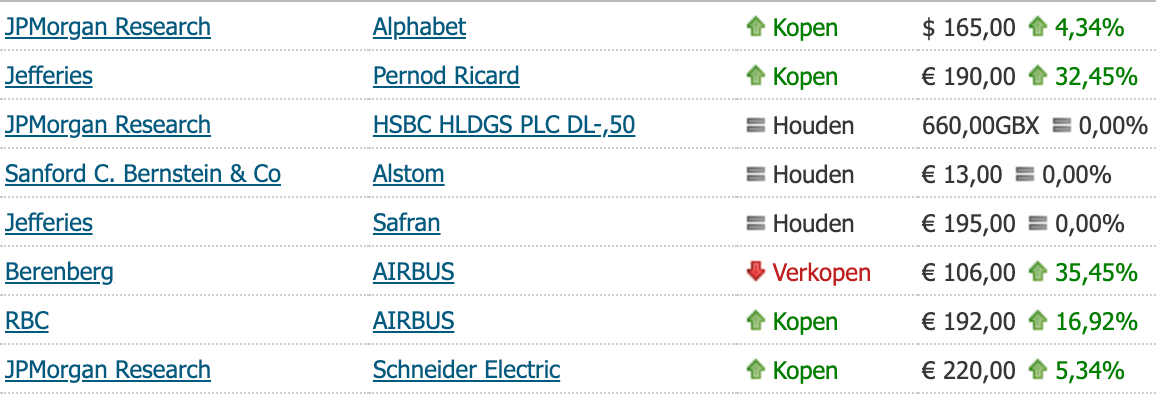

- Jefferies sets the price target of ASML (-0.46%) at €1260.

- DSM (-1.69%) puts the stock on sell with a price target of €75. IEX analyst Martin Crum is much more positive.

- Degroof Petercam has a price target of Exor (+0.20%) increases from €103 to €120. The investment company with major interests in Ferrari, Stellantis and Philips has achieved a strong annual result. According to ING, the discount is currently 38% on the net asset value and that is an excellent entry point.

- Ahold (0.0%) receives a price target increase (€28.50 to €29.50) from Jefferies, which sees more upside for the French Carrefour (-1.86%).

- Aegon (-4.05%) is dropping far today. The other interest-sensitive financials are also having a bad day, but not as bad as Aegon

- Shell (-0.25%) may be severely undervalued, but in the last two months the stock market value increased by 20%. There are now rumors that Shell is a takeover candidate or is considering a move of its headquarters to the US. Today the share was in the green for a long time, only to close in the red when the oil price started to fall.

- Fagron (+3.52%) today comes with good figures and is well rewarded for it. Read the analysis by IEX analyst Peter Schutte.

- Air France KLM (-4.29%) is also a dramatic share this year with a loss of almost 30%. High oil prices and a possible smaller Schiphol are reasons for this loss, but there are many other reasons why the airline is in the process of crash landing in slow motion.

- AMG Critical Materials (+3.25%) is also benefiting today from the recently started commodity rally? The share has risen 30% since the beginning of February, but is still almost 50% lower than the peak in the summer of last year.

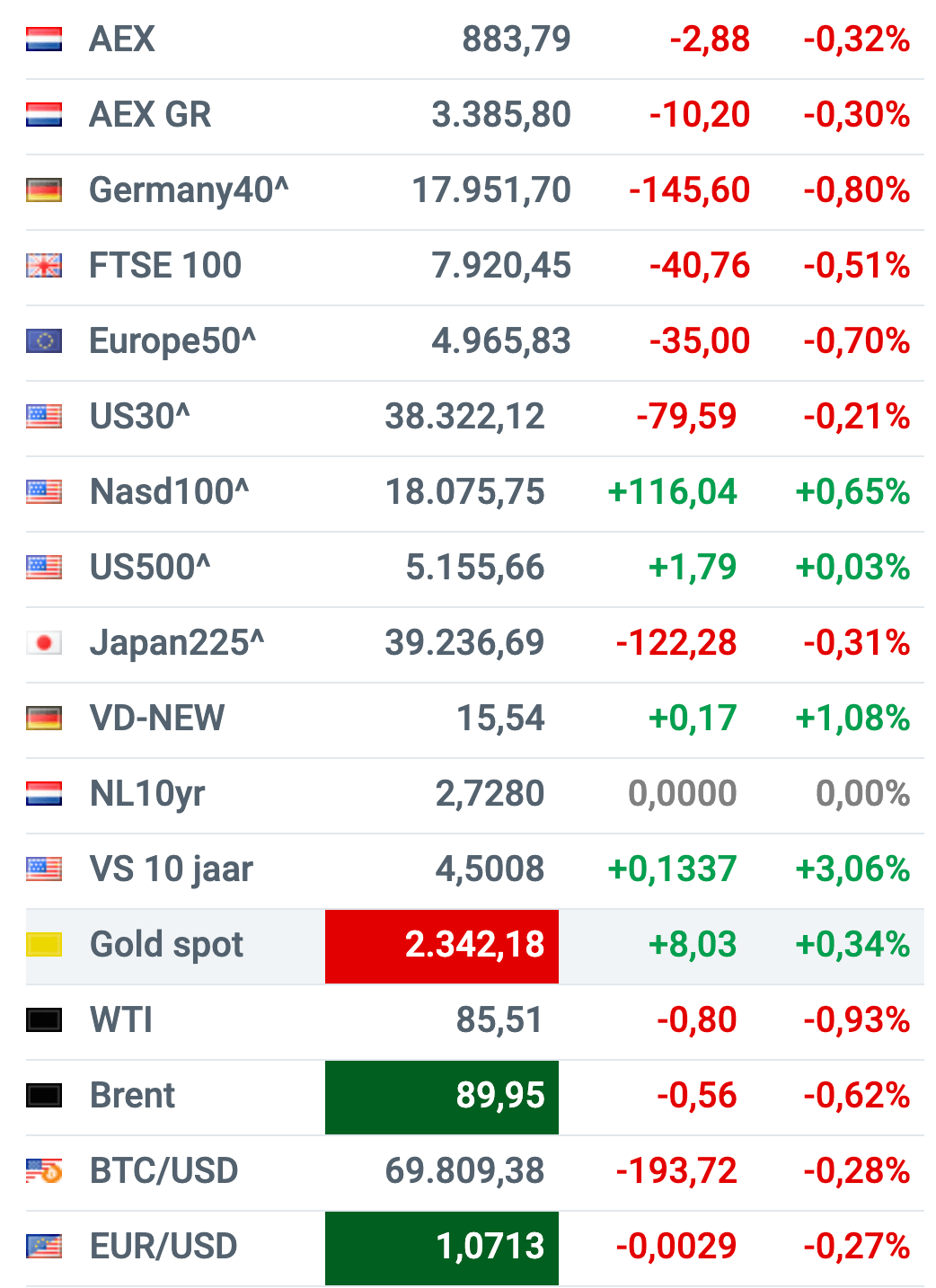

Broad market

Oil, euro and bitcoin are falling today, while gold is becoming slightly more valuable again. European stock markets close differently today, and the same can be said of the price movements on Wall Street. Just after closing in Amsterdam, the Dow is in the red and the Nasdaq in the green.

Interest rates rise

Bond prices are also falling today, causing interest rates to rise further. 2024 has been a pretty bad year for bond investors so far. For example, the interest rate on the Dutch ten-year bond has risen from 2.32% to 2.72%. The yield of the important US ten-year rose from 3.84% to 4.57% today. Those are big moves. So far, little has come of the positive bond expectations that asset managers expressed at the beginning of this year.

- Dutch ten-year (2.72%), +1.4%

- German ten-year (2.46%), +1.4%

- Italian ten-year (3.85%), +2.0%

- British ten-year (4.24%), +2.17%

- US ten-year (4.57%), +0.2%

- Japanese ten-year (0.85%), -0.8%

Reference time: 5 p.m

Latest stock recommendations

Agenda for Friday, April 12: Here come the American banks

Earnings season kicks off in the US on Friday, with the quarterly results of four major banks/asset managers: BlackRock, Citigroup, JP Morgan Chase and Wells Fargo.

Two shares will go ex-dividend: Ahold-Delhaize (€0.61) and BAM (€0.20). And some macroeconomic figures appear, including German inflation and the ‘small’ American consumer confidence, measured by the University of Michigan.

- 04:00 China, March trade balance

- 06:30 Japan, industrial production February

- 06:30 NL, bankruptcies in March

- 06:30 NL, international trade February

- 08:00 Dui, inflation March (final)

- 08:00 UK, Industrial Production February

- 08:00 UK, February trade balance

- 08:45 Fra, March inflation

- 09:00 Ahold Delhaize €0.61 ex-dividend

- 09:00 BAM €0.20 ex-dividend

- 09:00 BAM ex-dividend

- 09:00 SBM Offshore, annual meeting

- 12:00 BlackRock, first quarter results

- 1:00 PM Citigroup, first quarter results

- 1:00 PM JPMorgan Chase, first quarter results

- 1:00 PM Wells Fargo, first quarter results

- 2:30 PM US, March import prices

- 4:00 PM US Consumer Confidence (University of Michigan) April (Preliminary)

And then this:

AI is more than a hype

Siegfried Kok of OBAM IM has great expectations of AI in healthcare. According to him, AI can be of great significance in the field of medical technology, the search for new medicines, but also in hospitals. https://t.co/yrFGc4hfo8 pic.twitter.com/8XTymwYLc0

— IEXProfs (@IEXProfs) April 10, 2024

Social security is fine

Is social security in the Netherlands really that bad?

Not if you look at the numbers:

? poverty has never been so low

? incomes are rising faster than prices

? income inequality is not rising

? Dutch people get by better https://t.co/baEc3LCtBd— Peter Hein van Mulligen (@phvmulligen) April 11, 2024

Home bias damages returns

This certainly applies to Dutch investors.

The amount of “home bias,” the tendency for investors to favor domestic stocks over foreign ones, is shocking. This is especially the case in small countries such as the Netherlands. It gets even worse when you combine ‘home bias’ with ‘stock picking’, selecting… pic.twitter.com/nLu15KZSZr

— jeroen blokland (@jsblokland) April 11, 2024

Meanwhile, profit margins for Dutch businesses are declining

The average operating profit margin of companies falls to an average level, among other things due to: 1) the end of extreme scarcity in specific sectors such as energy and agriculture; 2) usual delayed response to workers’ compensation. Read more here: https://t.co/yyiqCkVXpj pic.twitter.com/dm2WRgLXiT

— Marcel Klok (@klok_marcel) April 11, 2024

Housing shortages matter more than higher mortgage interest rates

Rising prices and plenty of overbidding: madness on the housing market is back https://t.co/8Hmub0eNe5

— NU.nl (@NUnl) April 11, 2024

Rob Stallinga is a financial journalist. The information in his articles is not intended as professional investment advice or as a recommendation to make certain investments.

Unlock Full Article

Watch a quick video to get instant access.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.