The AEX index is heading for a flat to slightly lower opening, after Wall Street was under pressure yesterday following a disappointing inflation figure. Today, eyes are on the ECB, which makes an interest rate decision.

That interest rate decision itself is probably a non-event. But the financial markets are hungry for hints of an impending interest rate hike. Will ECB President Christine Lagarde accommodate investors in this regard? Or is she keeping her cards close to her chest?

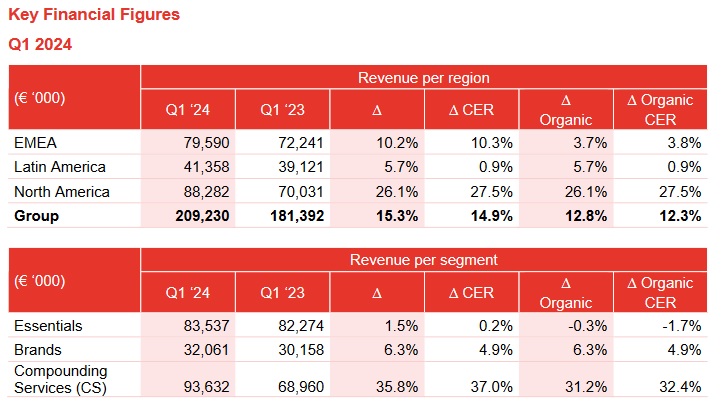

Fagron achieves record turnover

Today we have one figure: Fagron (an abbreviation of Pharmaceutical Raw Materials). The company announced record revenues of €209 million for Q1, 15% more than a year ago. That is €5 million more than analysts expected. As expected, things went well, especially in the US. The group is still targeting high single-digit organic sales growth and an increase in annualized profitability by 2024.

Keep an eye on the website, because analyst Peter Schutte delves into the figures.

Asian stock markets under pressure

Most Asian stock markets were under pressure last night, following on from Wall Street. There was also an inflation rate in China that caused disappointment. Only here the problem was not persistently high inflation (as in the US), but a tendency towards deflation.

Chinese consumer prices rose 0.1% year on year in March, up from 0.7% a month earlier and economists had expected an increase of 0.4%. On a monthly basis, prices even fell by 1%, while they still rose in February. It raises doubts as to whether economic growth will really get going.

In Japan, the prices of multinationals that export a lot were on the rise after the yen fell to the lowest level in 34 years. This kept the losses of the Nikkei and Topix limited, although there are also fears of an intervention by the Japanese central bank.

Here are the positions of the most important indices at a glance, clocked at 8 o’clock:

- Nikkei 225: -0.4%

- Shanghai Shenzhen CSI 300: +0.1%

- Hang Seng (Hong Kong): -0.3%

- Kospi (South Korea): +0.2%

Tech stocks were mainly in good shape:

- Samsung +1.1%

- Alibaba: +0.2%

- Baidu: -1.2%

- Prosus participation Tencent: +0.6%

- TSMC: +0.6%

Disappointing inflation figures drag Wall Street down

An interest rate cut by the Federal Reserve fell further out of sight on Wednesday when it turned out that inflation turned out to be higher than expected. That pulled down the Wall Street indices:

- S&P 500: -1%

- Nasdaq: -0.8%

- Dow Jones index: -1.1%

Delta Air Lines was one of the first major American companies to report figures. The results exceeded market expectations, but the price still fell by 2.7%.

Nvidia (+2%) managed to recover somewhat from the dip of the previous session.

US interest rate cuts further out of sight

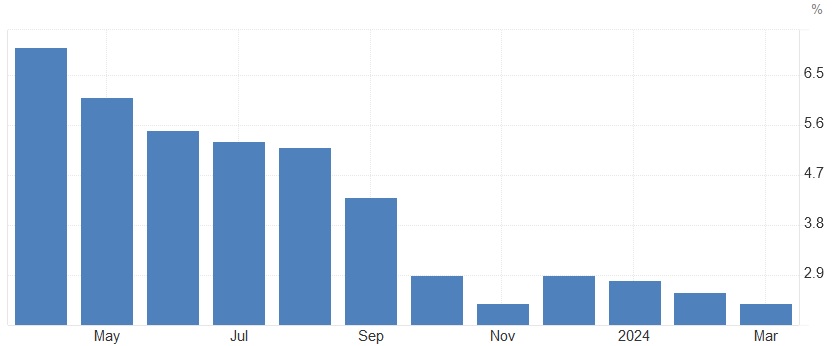

U.S. consumer prices rose 3.5% year over year in March, up from 3.2% in February and a forecast 3.4%. That was a dampener, because Fed Chairman Jerome Powell has clearly indicated that he first wants to have more confidence that inflation will fall sustainably towards 2% before he can turn the interest rate knob. That is clearly not the case now.

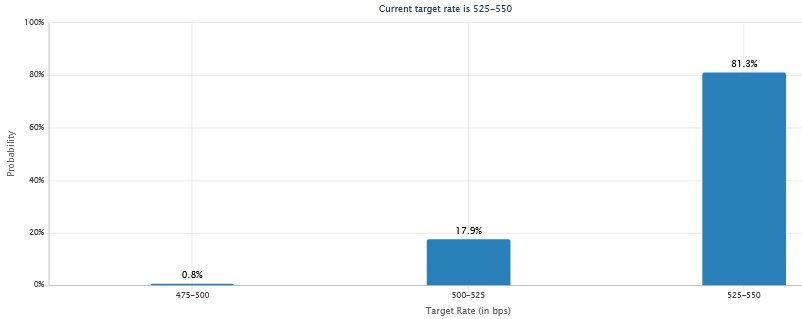

The market now seems to be aware that an interest rate cut in June is not an option. Before the inflation rate was announced, it was likely that the Fed would… federal funds rate (main interest rate) June 12 could be priced down to 54%. Now it is only a paltry 19.7%.

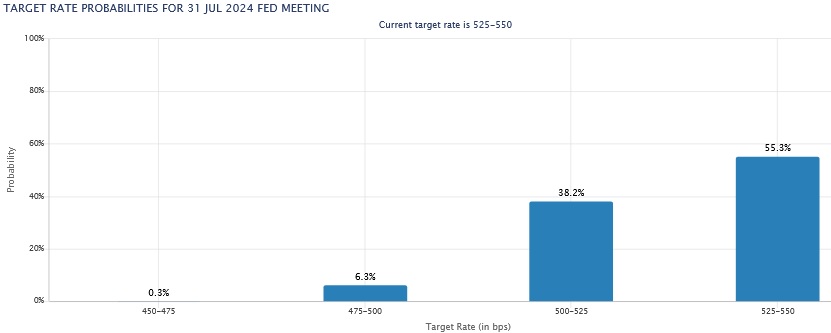

July then? Unfortunately, this too is in doubt. A month ago, lower interest rates seemed like a sure thing: that chance was priced at 90%. Last week that had shrunk to 75% and now only a minority (45%) expect the interest rate to be lower than it is now.

Minutes indicate a significant delay in reducing the balance sheet

The minutes of the interest rate meeting were also released yesterday. These confirmed the impression that Fed officials are concerned about persistently high inflation and are calling for a restrictive monetary policy.

In addition, there was discussion about the phasing out of the gigantic bond portfolio of approximately $7,500 billion that the Federal Reserve had built up during the corona pandemic. In the explanation of the previous interest rate decision, Powell already said that the Fed probably wanted to apply the brakes to prevent liquidity problems for banks. “We want a gradual transition to avoid shocks to the market,” he said at the press conference.

The minutes show that central bankers want to halve the pace of balance sheet reduction. That would mean limiting the runoff of maturing government bonds to $30 billion per month, down from $60 billion per month now.

The Fed has now reduced its balance sheet by $1.5 trillion since deciding to reduce that mountain in mid-2022.

American long-term interest rates are rising sharply and the gold price fell, for a while

Yesterday’s news had a significant impact on ten-year US Treasury yields. This rose considerably and is now above 4.5%, a level we have not seen since November.

The dollar was also on the rise. The gold price, on the other hand, was – briefly – under pressure. After all, if interest rates remain high for a longer period of time, this makes gold – on which you receive no interest – a less interesting asset. The rise in the dollar rate also put pressure on the gold price.

The question is whether this has removed the hatch. The fundamentals still stand. Gold is considered an attractive safe haven in uncertain times and central banks continue to buy gold, which supports the gold price. For that reason, the gold price cautiously recovered last night.

The indicators:

- The European stock markets are heading for a mixed opening.

- Most stock markets in Asia were under pressure last night.

- The CBOE VIX index (volatility) is rising and stands at 15.80.

- The euro is trading at 1.0737 against the dollar. That’s one cent lower than yesterday.

- The calm on the interest rate front has come to an abrupt end. The Dutch ten-year interest rate rose by 5 basis points to 2.68%. American interest rates rose twice as fast and now stand at 4.53%.

- The gold price is now rising again. For a troy ounce you have to pay $2,338.

- Oil prices are falling slightly. For a barrel of WTI you now pay $86.16. A barrel of Brent oil from the North Sea now costs $90.44.

- Bitcoin has settled above $70,000 again and is trading at $70,830. But these are always daily rates.

The AEX is expected to open 0.1% lower.

News, advice, shorts and agenda

- 07:59 AEX probably starts flat in the run-up to the ECB interest rate decision

- 07:22 Record turnover for Fagron

- 07:20 Asian stock markets are trading mainly lower

- 07:03 European stock markets are expected to open higher

- 06:57 Chinese producer prices continue to fall

- 06:55 Chinese consumer prices rose very slightly

- 06:51 Exhibition agenda: Dutch companies

- 06:51 Stock market agenda: foreign funds

- 06:51 Stock market agenda: macroeconomic

- April 10 Stock market update: AEX on Wall Street

- Apr 10 Wall Street closed lower

- Apr 10 Correction: Oil price closed higher

- Apr 10 Fed minutes: Fed wants to halve the pace of balance sheet reduction

- Apr 10 Record fine for exam fraud – and lies about it – at KPMG

- April 10 Wall Street heads for a lower close

- April 10 Ava Ahold Delhaize approves all agenda items

- Apr 10 European stock markets closed mostly higher

IEX also produces an overview of the most important news in the morning newspapers every morning. The complete news overview can be found here.

The AFM reports these shorts.

The number of short positions has increased since the rumblings at the top (renouncing the appointment of a new CFO).

Advice

It’s clearly the calm before the storm. JPMorgan has increased the price target for DSM-Firmenich from €70 to €75, but the sell recommendation remains intact.

Agenda: ECB interest rate decision and American PPI

Today, eyes are on Frankfurt, where the European Central Bank (ECB) makes an interest rate decision. Although surprises cannot be ruled out, the overall expectation is that the deposit interest rate (which banks receive when they deposit money with the ECB) will be maintained at 4.0%. But most economists expect a first interest rate step on June 6. This would put the ECB ahead of the Fed, because after yesterday’s US inflation figure, the hoped-for interest rate cut on June 12 is in doubt.

In the eurozone, on the other hand, inflation is well on its way to the desired 2%. Preliminary figures from Eurostat showed that consumer prices rose by 2.4% year-on-year in March, while an increase of 2.6% was recorded in February (and a 2.6% increase was expected).

Core inflation (excluding volatile items such as food and energy prices) stood at 2.9% on an annual basis, up from 3.1% the month before. So it is too high, but inflation is less ‘sticky’ here than in the US.

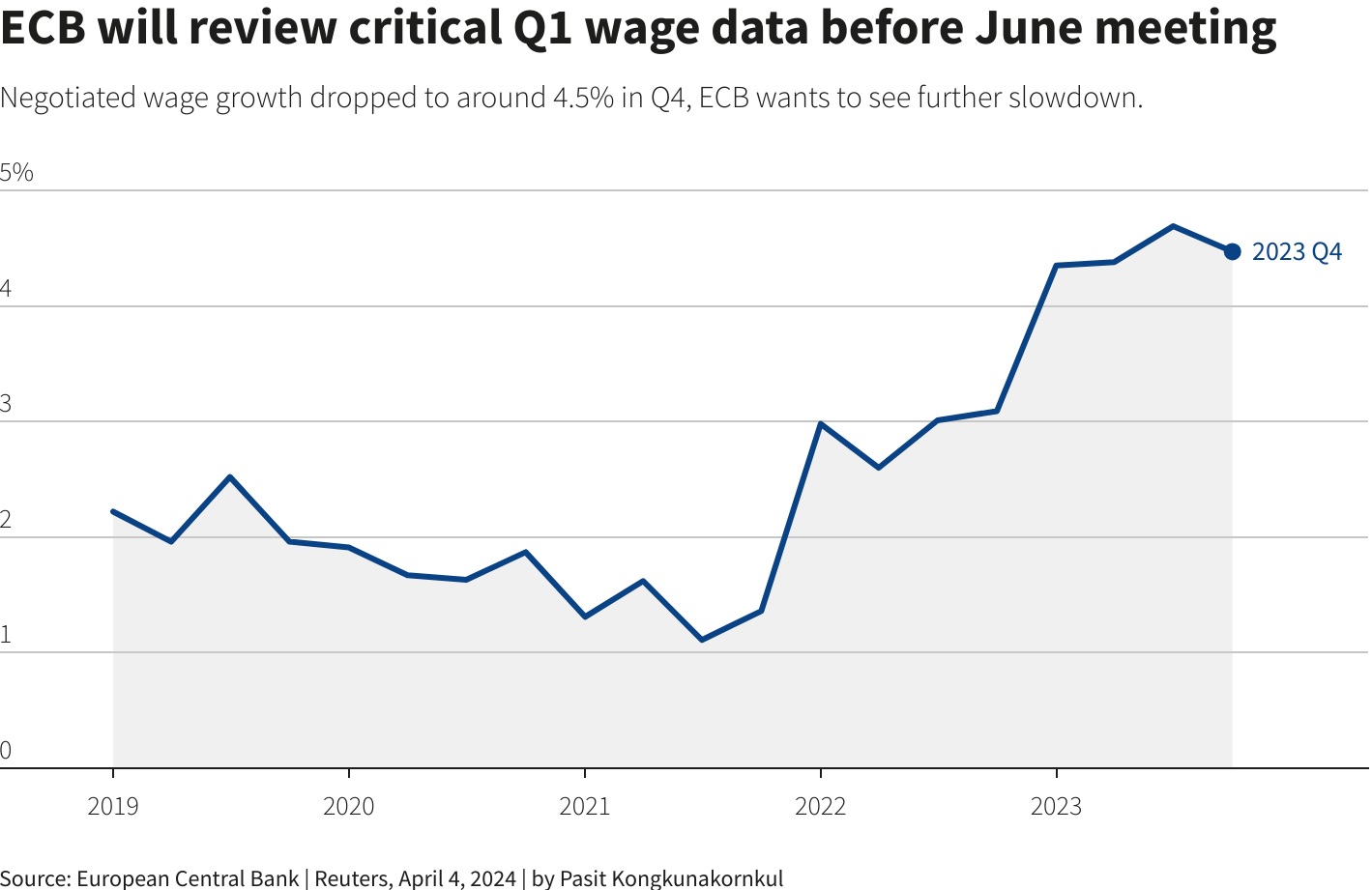

The question is how explicitly ECB President Christine Lagarde dares to speak out this afternoon about the moment when interest rates can be lowered for the first time. The development of the wage agreements in the first quarter has yet to be announced, and that will not be until May. If salaries rise too quickly, this could cause a wage-price spiral, where companies pass on the increased wage costs to customers, inflation still rises, employees want to be compensated for this, and so on. There is a good chance that Lagarde will take a hit.

In the fourth quarter, wage growth had fallen slightly to 4.5%. A further decline would suit the ECB.

Today we will also be looking at US producer prices, another (but less important) indicator of inflation. An increase of 0.3% month-on-month is expected and +0.2% for the core PPI. OPEC also publishes a monthly report on the oil market and the IMF presents a new economic outlook.

You’ve caught up again. Good luck and above all have fun today!

Unlock Full Article

Watch a quick video to get instant access.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.